Five Trends for Industrial Inkjet Printing in 2022

Demand is growing for faster digital printing and specialized ink due to coding and labeling requirements, and new consumer preferences.

By Kristin Adams, Marketing Manager at Kao Collins

New risks have cast a shadow on 2021’s robust economic recovery. Businesses are struggling to meet the pent-up consumer demand that grew during the global pandemic. Further, workforce shortages and the fragile supply chain remain wildcards heading into 2022, on top of concerns about new COVID-19 variants that could continue to threaten waves of business shutdowns.

New risks have cast a shadow on 2021’s robust economic recovery. Businesses are struggling to meet the pent-up consumer demand that grew during the global pandemic. Further, workforce shortages and the fragile supply chain remain wildcards heading into 2022, on top of concerns about new COVID-19 variants that could continue to threaten waves of business shutdowns.

This kind of uncertainty favors agile businesses. As industrial printers prepare for uncertain times and evaluate their production alternatives, the integration of digital printing takes on a new urgency.

Digital printing allows businesses to leverage the versatility of industrial inkjet inks that print many materials, combined with other benefits, such as a reduction in pre-press costs and make-ready waste, while delivering mass customization and shorter production runs.

We anticipate five trends and opportunities for industrial inkjet printing in the packaging industry in 2022 due to regulatory requirements for medical devices and pharmaceuticals, as well as the effects of new consumer shopping behaviors driving e-Commerce and demand for private label grocery items.

1. Medical UDI coding takes on greater urgency globally

Global standards for Unique Device Identification (UDI) of medical devices and equipment have simmered on the back burner for years since Japan first introduced requirements in 1999. The United States passed legislation requiring coding in 2007.

Most countries have now enacted similar regulations, or they are slated for implementation over the next few years. These regulations mandate UDI coding on medical devices, labels, and packaging for products ranging from bandages and tongue depressors to hospital beds and implants.

With a wide range of inks suitable for printing the many medical products, inkjet printing stands to come out as a winner for medical coding, marking and labeling.

2. Pharmaceutical regulations and fraud are increasing the need for coding and marking

The major factor driving the growth of the global security ink market is the increasing regulatory requirements involved with product tracking and the supply chain. Pharmaceutical companies face increasing pressure to adopt security practices that comply with shifting regulations, on top of curbing fraud and counterfeiting–and they are not alone.

The major factor driving the growth of the global security ink market is the increasing regulatory requirements involved with product tracking and the supply chain. Pharmaceutical companies face increasing pressure to adopt security practices that comply with shifting regulations, on top of curbing fraud and counterfeiting–and they are not alone.

Many industries fight a continuing battle against counterfeiters. The cost of counterfeit products in the United States alone totals $600 billion, according to the FBI’s Intellectual Property Rights division.

Coding and marking with overt and covert security inks makes it simpler for brand managers and regulators to identify counterfeit products. Overt or Level 1 security printing on packaging or labels appears visibly to the eye or tactilely. Visible fluorescent inks may be used for direct coding or incorporated in intricate label designs.

For a higher level of security, covert or Level 2 printing involves invisible inks or inks with unique formulations. Verification and validation involve ultra-violet lights, infrared readers, or calibrated readers, in the case of taggant inks. We anticipate growth in printing technology and inks that increase security to prevent fraudulent or compromised products that endanger consumers and brands.

3. E-commerce is boosting demand for labeling and customized packaging

E-commerce emerged as a clear winner in 2021, offering consumers a convenient alternative to traditional brick-and-mortar shopping. As retailers pivot to this new normal, they face the challenge of building customer relationships.

Digital printing offers personalization, customization, and the opportunity to create a brand experience with packaging that enhances the e-commerce experience and strengthens the brand’s connection with the end consumer. Look for eco-friendly LED-curable inks to fill this void for wide-format cardboard printing because of its many benefits over water-based inks, including:

- Weather resistance

- Excellent ink-to-substrate adhesion

- Wider-color gamut

- Rapid curing

While already well established for printing on flexible packaging, more companies are choosing LED-curable inks for cardboard packaging. The rapid, low-heat curing makes LED inks ideal for a wide range of cardboard and label facestock, especially compared to traditional UV-curable ink that uses mercury arc lamps for curing. LED bulbs last longer, use less energy, and don’t emit ozone or UVC radiation.

4. Consumer interest in private label products is boosting demand for digital printing

In 2020, grocery brands saw three consumer groups attracted to their private label products: Gen Z, Millennials and parents. While big brands regained some market share in 2021, the interest among these three groups reflects the elasticity of price and demand.

The expanding private label food industry stands to win more market share in 2022, as consumers look for quality alternatives to more expensive national brands to help manage their grocery costs. In November, the U.S. Bureau of Labor Statistics reported prices surged almost 7% for the previous 12 months. According to the Consumer Price Index, food prices increased just over 6% for the period.

Competing on price alone for food staples isn’t enough to propel sales of private label products. Consumers want premium products and a variety of flavors and packaging sizes. Combining premium food products with eye-catching packaging can elevate private label brands during inflationary periods and beyond.

Industrial inkjet printing offers private label food manufacturers the opportunity to produce segmented SKUs with efficiency and flexibility for brand packaging, and for the necessary marking and coding on shorter production runs.

5. Faster printing technology requires fast-drying inks

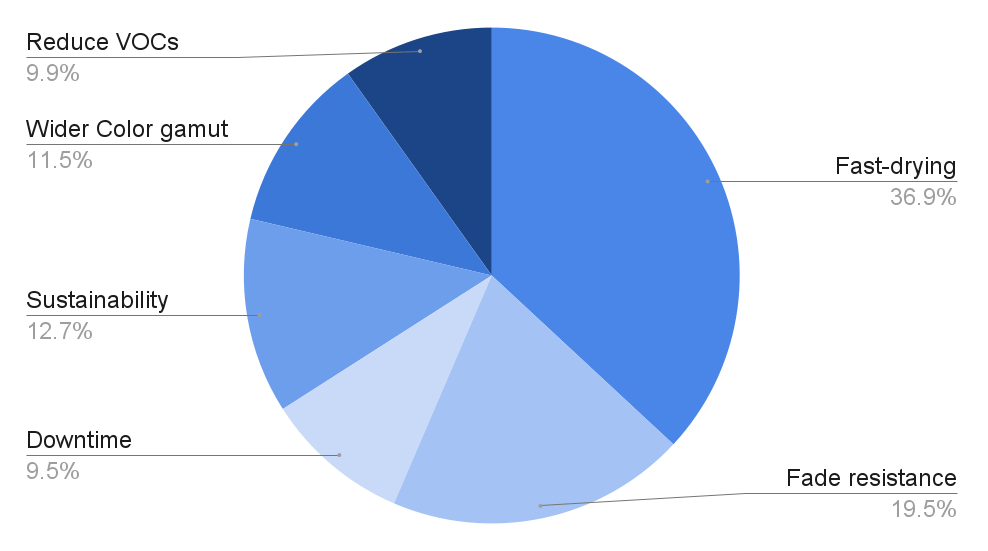

Advanced inkjet printing systems run faster than just a few years ago, and inks now have to dry or cure rapidly to keep pace with the new technology. In fact, interest in fast-drying ink outpaces other production priorities for users of industrial inkjet ink, based on analysis by DBS Interactive, a digital marketing agency in Louisville, Ky.

Users of the Kao Collins substrate and ink matching database show over 36% of users are looking for information about fast-drying inks. Fade resistance attracts about 20%. Solving downtime problems with inks attracts less than 10% of searches.

When applied to the proper material, most inks can achieve relatively fast dry times. Solvent and curable inks already dry or set rapidly – in a second or less. And manufacturers are always looking at ink formulations to improve aided and unaided dry time, reduce fading and prevent downtime.

Packaging printing and label printing are the common threads for almost all of the industrial inkjet trends for 2022, and the key drivers are:

- Integration with automated production systems

- Compensating for increasing SKUs (“SKU-mageddon”)

- e-Commerce market growth

- Mass customization

- Improving return on investment

- Growing adoption of digital over analog printing systems

Market demand and the need to squeeze more out of the benefits of digital printing will continue to drive the need for technology to develop inks and faster industrial inkjet printers.

About the Author

Kristin Adams is the marketing manager of Kao Collins Inc., based in Cincinnati, Ohio, and has been with the company for almost 20 years. She works closely with the R&D and technical teams to increase opportunities for existing and emerging applications of industrial inkjet printing. Kao Collins supplies a wide range of inks for thermal, piezo and continuous inkjet systems. Learn more online at www.kaocollins.com/inks.